Table of Content

- Refinance Rates & Loans open

- Can I save money with a refinance? Is now a good time to refi?

- Articles related to mortgage refinances and rates

- Shop Around for the Best Rate

- Is It a Good Time to Buy a Home With Rates Where They Are?

- Annual percentage yield (APR)

- Refinance your first mortgage with a low, fixed rate loan from 6.74% APR to 10.99% APR

To use some of the Services, you may need to provide information such as credit card numbers, bank account numbers, and other sensitive financial information, to third parties. By using the Services, you agree that Interest.com may collect, store, and transfer such information on your behalf, and at your sole request. You agree that your decision to make available any sensitive or confidential information is your sole responsibility and at your sole risk. Interest.com has no control and makes no representations as to the use or disclosure of information provided to third parties.

That's a lot more than the monthly payment on even a 15-year refinance, but in return you'll pay even less in interest than you would with a 15-year term. Take a look at mortgage refinance rates for a number of different loans. You can use our mortgage calculator to get an idea of what your monthly payments will be and find out how much less interest you’ll pay by making additional payments. Our mortgage calculator will also show you how much interest you’ll be charged over the entire loan term. Refinancing your mortgage can be a wise move for many reasons, most notably lowering your interest rate or your monthly payments. It can also help you pay down your mortgage sooner, access your home’s equity or get rid ofprivate mortgage insurance .

Refinance Rates & Loans open

NerdWallet’s comparison tool can help you find the current refinance rates for your mortgage. In the filters above, click or tap the "Refinance" button and enter a few details about your current home loan. We’ll scan multiple lenders to find personalized refinance offers and provide you with personalized rate quotes within moments, without a credit check.

If you have excellent credit, which is typically 720 or above, you may qualify for the lowest refinance rates. A rate and term refinancemay allow you to reduce your monthly mortgage payment. Adjustable-rate mortgages, or ARMs, are home loans that come with a floating interest rate. To put it another way, the interest rate can change periodically throughout the life of the loan, unlike fixed-rate mortgages. These types of loans are best for those who expect to refinance or sell before the first or second adjustment.

Can I save money with a refinance? Is now a good time to refi?

As always, consider your goals and circumstances, and compare rates and fees to find a mortgage lender who can meet your needs. We use information collected by Bankrate, which is owned by the same parent company as CNET, to track daily mortgage rate trends. The above table summarizes the average rates offered by lenders across the country. One of the most important factors is your credit score; people with lower credit scores may pay a higher interest rate than someone with a better score. Borrowers with FHA loans must refinance into a conventional loan in order to get rid of their mortgage insurance premium, which can save hundreds or thousands of dollars per year.

At the current average rate, you'll pay $628.78 per month in principal and interest for every $100,000 you borrow. That represents a decline of $12.52 over what it would have been last week. While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen. There are a ton of different reasons to refinance, so ultimately the answer of when to refinance will be up to your goals and needs.

Articles related to mortgage refinances and rates

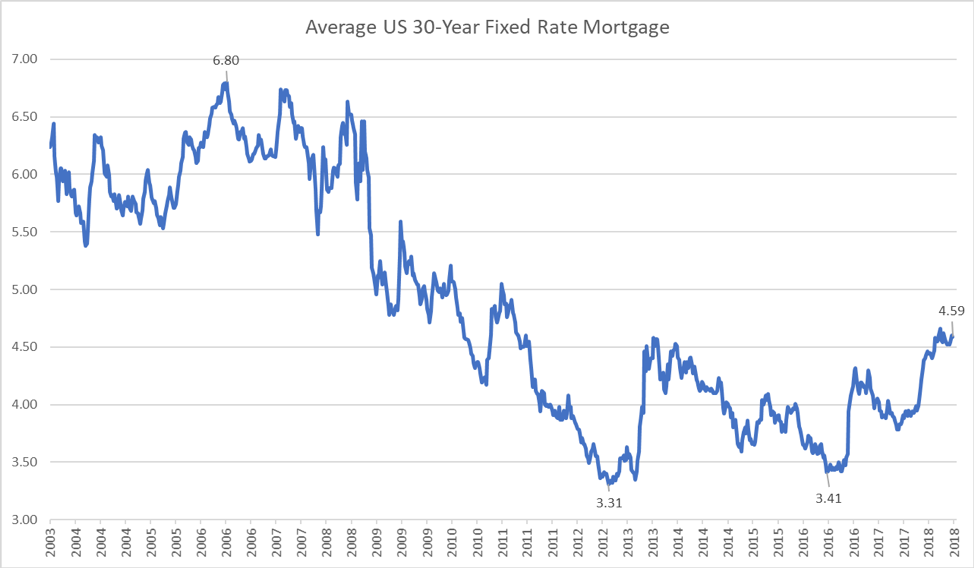

The APR is the all-in total of your mortgage costs, which can vary by lender, and will include your closing costs if rolled into your loan. “With mortgage rates soaring to the highest levels since 2008, the opportunity to refinance into a lower rate has largely passed for most homeowners,” says Danielle Hale, chief economist for Realtor.com. Hale expects rates to settle between 5.5% and 6% from now to the end of 2022.

Estimated monthly payments shown include principal, interest and any required mortgage insurance. Jumbo Loans - Annual Percentage Rate calculation assumes a $940,000 loan with 20% borrower-equity and borrower-paid finance charges of 0.862% of the loan amount, plus origination fees if applicable. Jumbo rates are for loan amounts exceeding $647,200 ($970,800 in Alaska and Hawaii). Most housing and mortgage experts predict that refinance rates will land somewhere between 5% and 6% by the end of the year. SunTrust offers a wide variety of refinancing options, including loans in 15- and 30-year terms as well as easier-to-obtain FHA loans and VA loans for veterans.

Shop Around for the Best Rate

Keep in mind, it could take a few years to recoup your refinance fees. If you expect to move in a few years, the trouble and expense of refinancing now might not make sense. Alix is a staff writer for CNET Money where she focuses on real estate, housing and the mortgage industry. She previously reported on retirement and investing for Money.com and was a staff writer at Time magazine. She has written for various publications, such as Fortune, InStyle and Travel + Leisure, and she also worked in social media and digital production at NBC Nightly News with Lester Holt and NY1. She graduated from the Craig Newmark Graduate School of Journalism at CUNY and Villanova University.

You are leaving Discover.com and entering a website operated by a third party. We are providing the link to this website for your convenience, or because we have a relationship with the third party. Discover Bank does not provide the products and services on the website. Please review the applicable privacy and security policies and terms and conditions for the website you are visiting.

HELOCs also may give you tax advantages over home equity loans, but you’ll need to research whether or not you’d qualify for these tax breaks. It’s been a bad 2022 for mortgage rates, but things might be looking up a bit heading into 2023. Refinance rates were mixed this week, but one key rate tapered off. The Fed's interest rate hikes have affected the refinance market.

A month ago, jumbo mortgages' average rate was higher, at 6.84 percent. The average rate on a 5/1 adjustable rate mortgage is 5.46 percent, falling 2 basis points over the last 7 days. Rate and term refinance — This type of refinance allows you to replace your current mortgage with a new mortgage with a different rate, term or both.

It’s always a good idea to get multiple loan estimates when you’re trying to capture the lowest rate available. You can use the best estimate to negotiate with other lenders, which might result in getting a lower rate or reducing certain administrative fees. In addition to the qualification process, refinancing costs can be substantial, totaling up to 6% of the original loan’s outstanding principal.

This may influence which products we write about and where and how the product appears on a page. Shopping around for a mortgage is a great way to secure the lowest mortgage interest rate. To learn more about the different rate averages Bankrate publishes, see "Understanding Bankrate's Rate Averages." Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Refinance your first mortgage with a low, fixed rate loan from 6.74% APR to 10.99% APR

No matter what kind of refinance you decide to undertake, once you close on your new loan, the payment clock goes back to zero. So, for example, if you take out a new 30-year mortgage, you’ll have another 30 years of payments ahead of you. "Until inflation peaks, mortgage rates won't either," says Greg McBride, CFA, Bankrate chief financial analyst. The 15-year fixed refi average rate is now 5.91 percent, unchanged from a week ago.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. © 2022 NextAdvisor, LLC A Red Ventures Company All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use, Privacy Policy and California Do Not Sell My Personal Information.